𝗦𝗢𝗟𝗩 𝗘𝗡𝗘𝗥𝗚𝗬 𝗣𝗥𝗘𝗣𝗔𝗥𝗘𝗦 𝗙𝗢𝗥 𝗡𝗔𝗦𝗗𝗔𝗤 𝗟𝗜𝗦𝗧𝗜𝗡𝗚 𝗔𝗦 𝗨𝗣-𝗖 𝗜𝗣𝗢 𝗙𝗢𝗖𝗨𝗦𝗘𝗦 𝗢𝗡 𝗨𝗧𝗜𝗟𝗜𝗧𝗬-𝗦𝗖𝗔𝗟𝗘 𝗦𝗢𝗟𝗔𝗥 𝗘𝗫𝗘𝗖𝗨𝗧𝗜𝗢𝗡

San Diego-based Solv Energy, Inc. has filed for a Nasdaq IPO under the ticker MWH, offering 20.5 million shares of Class A common stock at an initial price range of $22 to $25, with an expected deal size of $471.3 million at the midpoint. The IPO is being led by Jefferies and J.P. Morgan as joint lead bookrunners, joined by a broad syndicate including KeyBanc, TD Cowen, UBS, Evercore ISI, and others. The offering would value the company at a $4.7 billion enterprise value, based on 100% of the post-IPO economic interest in Solv Energy Holdings LLC.

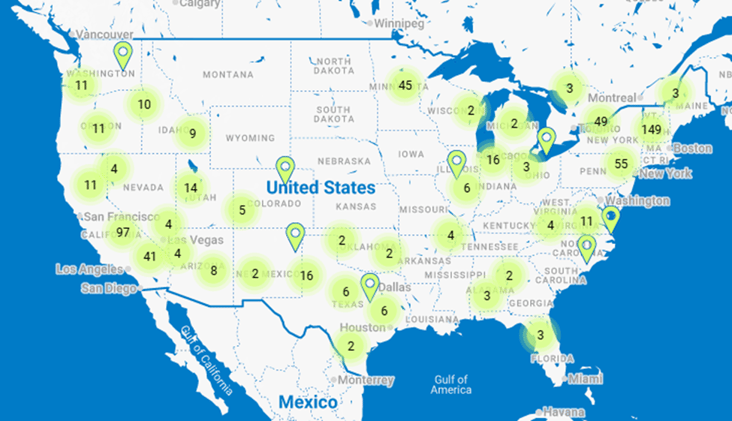

SOLV Energy is the largest pure-play EPC (engineering, procurement, construction) contractor for utility-scale solar projects in the U.S., with over 22 gigawatts of capacity installed across 100+ projects. The company has grown into a leading infrastructure execution partner for solar developers, utilities, and IPPs, leveraging strong relationships across supply chains and labor markets. It offers end-to-end services including design, procurement, installation, and long-term operations and maintenance. The IPO proceeds will support general corporate purposes, including strengthening the balance sheet and expanding bonding capacity, which is critical for bidding on larger infrastructure contracts. The offering follows an Up-C structure, with American Securities retaining control through high-vote Class B shares, while public investors will hold only Class A common stock with limited governance rights.

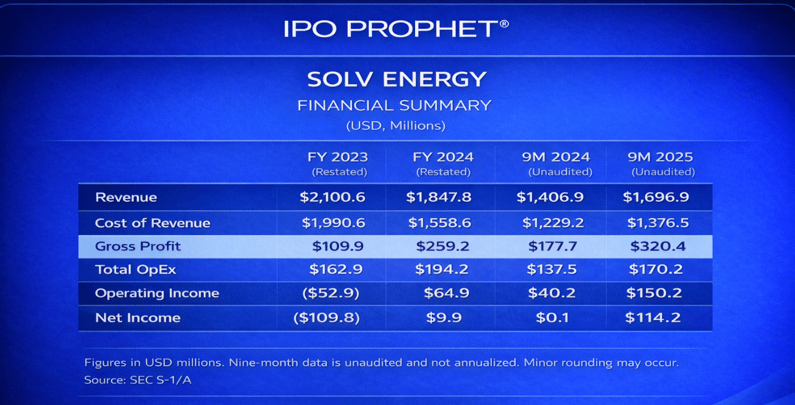

Financially, SOLV has shown significant top-line growth and improving profitability. Revenue reached $2.1 billion in FY 2023, then $1.85billion in FY 2024, and already $1.70 billion in the first nine months of 2025,putting the company on pace to exceed $2.3 billion in annualized revenue. Gross profit has steadily expanded from $109.9 million in 2023 to $259.2 million in2024, and $320.4 million through 9M 2025, supported by operational improvements and better project pricing. Operating income flipped from a ($52.9 million)loss in FY 2023 to $64.9 million in FY 2024, then surged to $150.2 million in9M 2025, indicating strong leverage on fixed costs. Net income followed a similar trend, moving from a loss of ($109.8 million) to a modest $9.9 million profit in 2024 and $114.2 million YTD in 2025. These results reflect a successful operational turnaround following supply chain volatility and labor constraints that plagued the broader solar EPC market in prior years.

Relative to peers, SOLV occupies a unique niche. It does nor manufacture hardware like First Solar or Shoals Technologies, but it provides mission-critical infrastructure services at national scale. Comparables include Array Technologies (ARRY) and Shoals (SHLS) in the solar supply chain, and diversified EPC firms such as Fluor (FLR) and Quanta (PWR). Given its size, profitability, and clean balance sheet, SOLV may trade around 1.0x–1.5xEV/Revenue, suggesting valuation upside if post-IPO execution is strong. The company also benefits from its position at the intersection of infrastructure, clean energy, and long-term services—a valuable trifecta as federal and state decarbonization mandates accelerate.

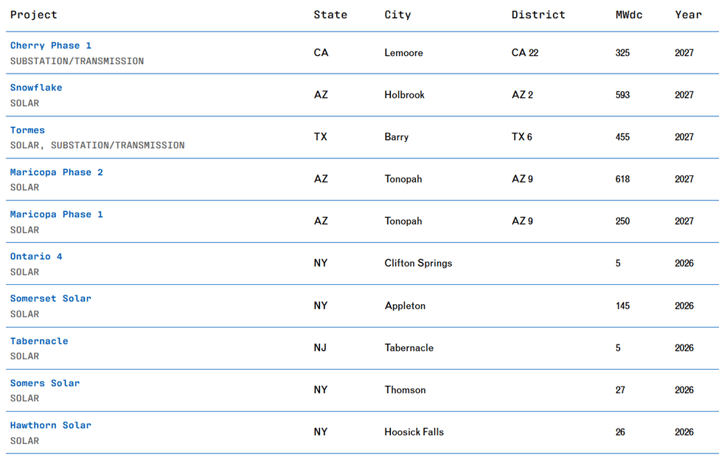

Looking ahead, SOLV is well positioned to capture growth from the Inflation Reduction Act, which expands tax incentives for utility-scale solar and storage. The company has a large contracted backlog and pipeline, with growth opportunities in grid-tied battery systems, hybrid solar-plus-storage projects, and expanding O&M recurring revenues. The IPO proceeds could be deployed to expand bonding lines, support selective M&A, and reinforce its national labor and logistics footprint. As the industry shifts from boom-bust cycles to steadier growth, SOLV aims to offer investors amore stable, margin-accretive solar infrastructure play.

Still, risks remain. As a fixed-bid contractor, SOLV bears execution risk on pricing, labor, and project timelines. It also faces customer concentration risk, policy uncertainty, and working capital volatility. The Up-C structure and concentrated voting control by American Securities may be off-putting for some investors seeking governance transparency. However, if SOLV continues to demonstrate disciplined project execution, margin improvement, and backlog conversion, the stock could offer both growth and infrastructure-style defensiveness in the clean energy transition.

Look for Solv Energy's IPO to trade on Wednesday, February 11th, 2026.