The IPO market delivered a wide range of outcomes in today’s triple-header, reinforcing how...

Analogues Over Anecdotes: Calibrating Wealthfront’s Trading Path

Wealthfront is expected to begin trading on Friday, December 12, 2025, under the ticker WLTH on the Nasdaq Global Select Market. The IPO comprises 34.6 million shares—approximately 21.5 million new shares issued by Wealthfront and 13.1 million shares offered by existing shareholders—at a price range of $12.00 to $14.00 per share.

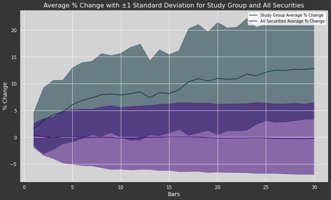

As is our practice, we start by establishing context using analogues—past offerings that share structural, economic, or behavioral similarities with the new issue. These reference points help frame expectations for early trading by illustrating how the market has historically responded to comparable businesses. As we like to say, history doesn’t repeat, but it often rhymes.

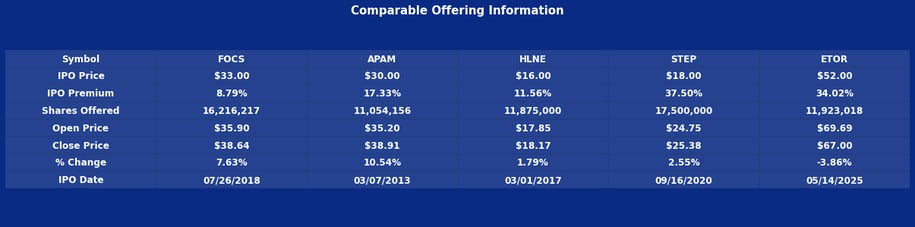

In Wealthfront’s case, the appropriate mental model is that of a technology-enabled financial adviser. The company uses software to deliver a disciplined, systematic, and highly consistent advisory experience, but the underlying economics remain fee-based, similar to traditional wealth-management firms. Because of this, we find it useful to anchor our analysis with the IPOs of Focus Financial (FOCS), Artisan Partners (APAM), Hamilton Lane (HLNE), and StepStone (STEP). Each represents a scaled advisory or asset-management platform with public-market trading patterns that reflect what investors typically expect from fee-driven businesses: stable openings, measured follow-through, and solid—but rarely explosive—100-day performance.

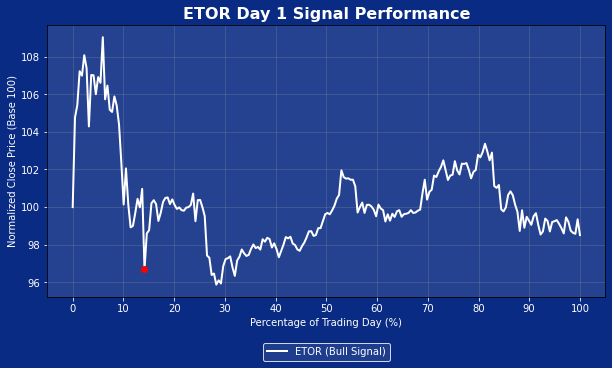

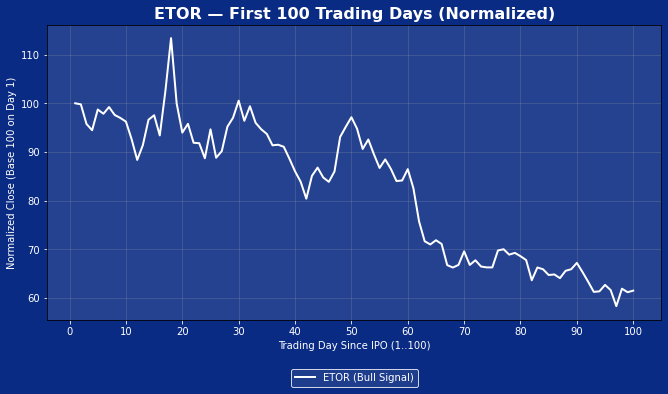

While eToro (ETOR) and Wealthfront share certain surface similarities—both are digital platforms aimed at retail investors—their economics diverge meaningfully. eToro’s business model is transaction-based, not fee-based. Nevertheless, because ETOR went public earlier this year, its trading behavior offers a proximal reference point, particularly for assessing the broader fintech appetite in the current market.

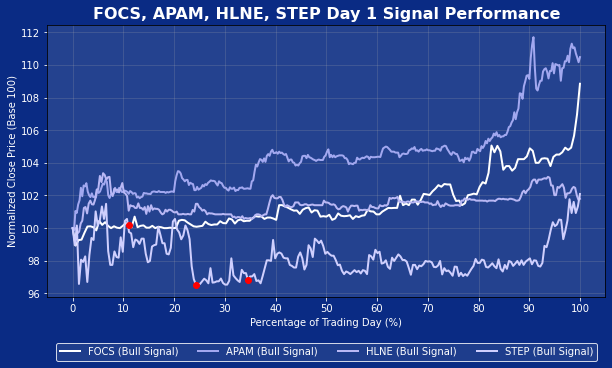

The Day-One analogue plot reinforces the idea that advisory-style IPOs generally produce benign, controlled trading sessions regardless of whether a Bull Signal is triggered. All four offerings—FOCS, APAM, HLNE, and STEP—opened cleanly and settled quickly into narrow intraday ranges, with virtually no signs of the sharp upside extensions that characterize higher-beta consumer tech or transactional fintech debuts. Even STEP, the strongest analogue, showed strength expressed as gradual firming, not a breakout. Drawdowns were shallow and intraday volatility remained modest across the group, suggesting that institutional investors, rather than speculative flows, tend to dominate price discovery in this category. In short, a Bull Signal in these offerings generally reflects stable trading, not intense momentum—useful context when thinking about WLTH’s potential Day-One behavior.

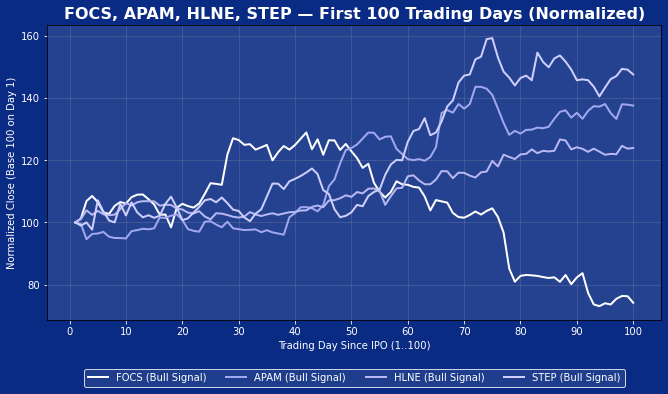

The 100-day performance analogue shows a similarly cohesive story of disciplined early-life trading. FOCS and APAM form the core behavioral cluster, appreciating steadily within a +5% to +20% range and rarely straying far from trend. HLNE demonstrates a somewhat stronger drift profile, occasionally testing the +20–25% zone. STEP stands out as the lone analogue exhibiting a sustained trend phase, advancing 40–60% over its first quarter of trading—but importantly, even STEP’s trajectory reflects orderly compounding, not volatility-driven or sentiment-induced acceleration. Across the set, there is little evidence of explosive convexity or outsized momentum, underscoring that the market typically values fee-based advisory models through predictable, fundamentals-anchored repricing. If Wealthfront trades in line with history, its early path will likely resemble this steady compounding profile unless investors assign it a more fintech-oriented premium.

eToro is worth a proximal look given that the offering came to market this year and is somewhat comparable to Wealthfront; to that end, it’s clear that bull was grabbed by the horns and tossed out to pasture. Despite an early bull signal, ETOR’s first day quickly slipped into a fading tape where initial strength evaporated and buyers never re-engaged with conviction. That early weakness proved to be a fair tell: over the first 100 days, ETOR drifted steadily lower — roughly a 40% decline — with only brief, non-directional rallies interrupting the slide. The broader takeaway is that early enthusiasm only matters if it converts into persistent demand, and ETOR’s trajectory is a reminder of how swiftly an IPO can transition from constructive to structurally fragile when the market steps aside.

Taken together, the analogue set provides a clear and instructive frame of reference for Wealthfront’s debut. The core comparison group—FOCS, APAM, HLNE, and STEP—captures the trading behavior typically associated with fee-based advisory businesses: orderly openings, muted intraday volatility, and steady early-life compounding driven by fundamentals rather than sentiment. eToro, while superficially similar in its digital delivery and retail orientation, operates on a fundamentally different economic model and therefore does not meaningfully inform the core expectation range for WLTH. It is useful as a peripheral data point in gauging broader fintech appetite, but the most reliable guide to Wealthfront’s early trading comes from the advisory cohort. These analogues suggest a debut defined by stability rather than spectacle, with the potential for moderate outperformance if investors lean into the technology-enabled aspect of the story.