EquipmentShare Brings Construction-Tech Platform to the Public Markets

EquipmentShare.com Inc. has filed to go public on the Nasdaq Global Select Market under the ticker EQPT, offering 30.5 million shares of Class A common stock at an indicated price range of $23.50 to $25.50 per share, implying gross proceeds of approximately $747 million and an a fully diluted market capitalization of approximately $6.7 billion at the midpoint. The offering is being led by Goldman Sachs, Wells Fargo Securities, and UBS Investment Bank, with Citigroup and Guggenheim Securities also participating in the syndicate. The offering comes at a moment when investors are willing to underwrite industrial and infrastructure-adjacent businesses, provided they can demonstrate durable demand, operational discipline, and a credible path to sustaining margins across cycles.

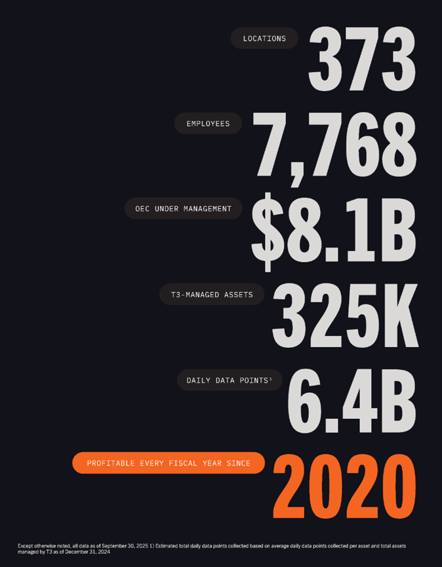

Founded in 2014, EquipmentShare operates at the intersection of construction equipment rental, fleet logistics, and software-enabled asset management. While the company generates the majority of its revenue from renting and selling construction equipment, management emphasizes its proprietary technology stack as a key differentiator. This includes telematics hardware, fleet tracking software, and jobsite data tools embedded directly into the company’s owned equipment fleet. The strategy is designed to improve asset utilization, reduce downtime, and increase customer retention, creating a tighter operating loop than that of a traditional rental model.

The distinction between being valued as an equipment rental business versus a technology-enabled operating platform is likely to sit at the center of the investment debate. Public investors will ultimately determine whether EquipmentShare’s integrated approach justifies valuation treatment beyond that of conventional rental peers, particularly as growth normalizes and the company matures in the public markets.

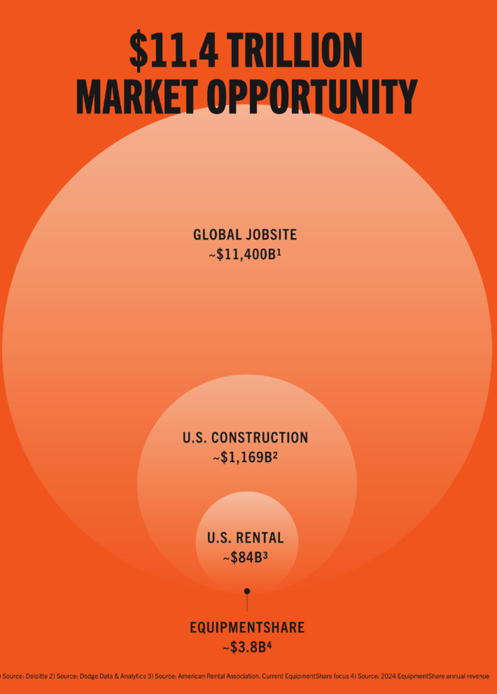

From a market perspective, EquipmentShare operates in a large but cyclical industry. Construction equipment demand is closely tied to non-residential construction activity, infrastructure spending, and broader economic conditions. While long-term infrastructure investment and project backlogs provide support, the business remains sensitive to interest rates, project financing conditions, and macroeconomic slowdowns. As a result, scale, utilization discipline, and cost control become critical drivers of performance through economic cycles.

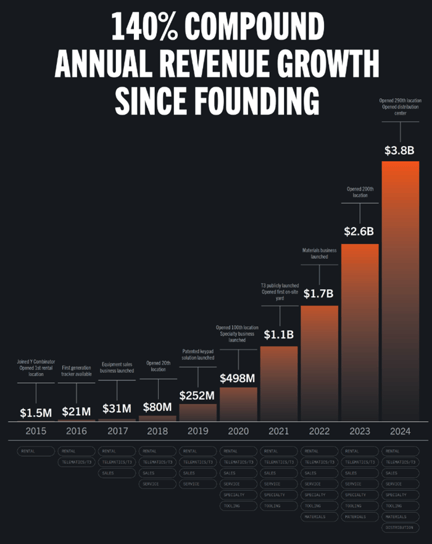

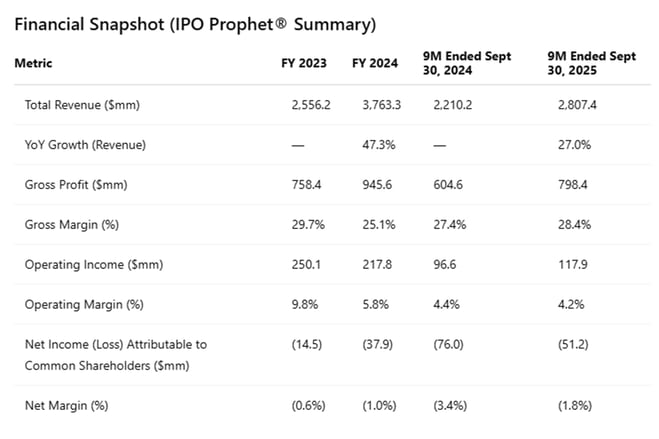

Financially, EquipmentShare has delivered rapid top-line expansion as it has grown its branch network and expanded its owned fleet. Revenue was up 47% between 2023 and 2024, reflecting aggressive growth and increased penetration across its markets. At the same time, margins have fluctuated as the company continues to invest heavily in fleet expansion, logistics capabilities, and technology development. Operating income has remained positive, though operating margins have compressed relative to earlier periods.

The financial profile highlights both the opportunity and the trade-offs embedded in the story. Growth remains robust, but profitability metrics reflect continued reinvestment and the capital-intensive nature of the business. For public investors, the focus is likely to center on whether margin stability and operating leverage can improve as branch growth moderates and utilization increases.

Following the IPO, EquipmentShare will maintain a dual-class share structure, with founders retaining control through high-vote Class B shares. As a result, the company will qualify as a controlled company, a factor institutional investors will weigh alongside management credibility and governance practices.

Proceeds from the offering are expected to be used for general corporate purposes, including continued growth initiatives, capital expenditures related to fleet expansion, and potential debt repayment. Given the capital intensity of the business, capital allocation discipline post-IPO will be closely watched.

From a risk perspective, the primary considerations are not unusual for a company of this type. Exposure to construction activity introduces cyclicality, while rapid expansion carries execution risk. Margins remain sensitive to fleet utilization, depreciation, and logistics costs, and competition from both national rental chains and regional operators remains intense. In addition, the controlled-company structure places greater emphasis on transparency and alignment with public shareholders.

Ultimately, EquipmentShare’s IPO represents a test case for how technology-enabled industrial platforms are valued in a selective IPO market. The company offers scale, growth, and a differentiated operating model, but it also operates in an industry where cycles and execution matter. For investors, the question is less about near-term growth and more about whether the company can translate its platform strategy into consistent economics over time.

In a market that is rewarding clarity and fundamentals, EquipmentShare enters the public arena with a compelling but closely scrutinized profile. How the stock performs beyond its debut will depend on execution, margin discipline, and the company’s ability to prove that its technology-driven approach can deliver durable value across cycles.

EquipmentShare is expected to IPO the week of January 19th, 2026