In The Prophet’s Perspective, we aim to stay in our lane—delivering insights specific to our...

The IPO Prophet’s Perspective – The Week of April 21st, 2025

Stranger Things…

Since Trump’s “Liberation Day” speech on April 2, we’ve been trying to make sense of where all this is going—markets, rates, the dollar, everything. We’ve been at this since the 1990s. We’ve seen the dot-com collapse, the Great Financial Crisis, COVID… and now whatever this is. In every one of those moments, something new has emerged as the thing to watch. A new canary in the coal mine.

Back then it was credit default swaps. Then crude oil went negative. Now it’s the basis trade, interest rate spreads, and the dollar that seem to be front and center.

But when it comes to the IPO market, there’s not much that can be said with conviction. The usual takes don’t carry much weight. You’ll hear someone point to the VIX and say, “If it gets back to 17, things will open up again.” Maybe. Maybe not. What I imagine is happening behind the scenes is that companies still prepping to go public are just trying to keep the wheels on—hoping things settle down, hoping strategy still holds, hoping valuations don’t slip away. Yes, lots of hope in that strategy.

And then—last week—we see Chagee Holdings hit the tape. A Chinese ADS. Prices at the top of the range. Opens with a 20% premium. In this environment? With China in the crosshairs of trade tension and the IPO market freezing over again? It made no sense. But it happened. Bizarro world.

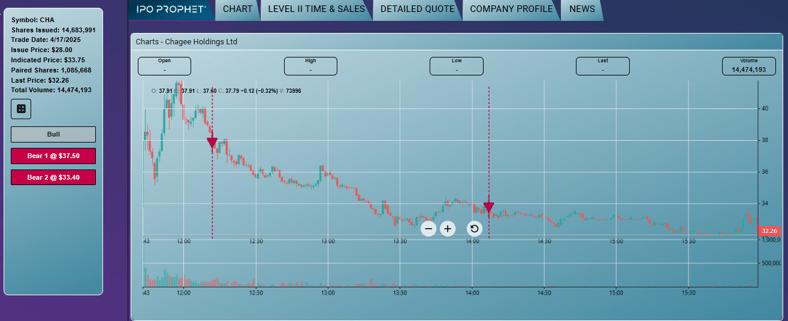

Since we launched in January of this year, it has been so frustrating that every IPO that has come to market has amounted to a stress test for our algorithms where demonstrating the value of our process has been in protecting against losses. Oddly enough, this is probably the critical measure of success for our models, but truly we long for the days where IPOs open and run. Once again in 2025 our signals were prescient. Chagee Holdings priced at the high-end, opened with a premium of 20% and had a hint of promise. But, in our algorithms our “Bull Signal” was not satisfied, so for us it was not to be bought and allocations should be sold. Following a brief move higher, the stock reversed and traded lower throughout the day. Our signals run independently, so despite not having received a “Bull Signal,” it was still possible for our “Bear Signals” to be triggered—and both did in fact go off—demonstrating once again that our capital protection strategy is running on point.

The chart below shows the Chagee trade through our lens: no Bull Signal, followed by the activation of both Bear 1 and Bear 2. It was never a buy — and that made all the difference.

These are strange times. And this isn’t the kind of success anyone wants to write about. But sometimes surviving the weird chapters is the most important part of the story.