Aktis Oncology Launches the 2026 IPO Calendar With Nasdaq Offering

Aktis Oncology, Inc. is set to become the first IPO of 2026, formally opening the new issuance calendar with a Nasdaq Global Market debut under the ticker AKTS. The Boston-based oncology company is bringing a clinical-stage radiopharmaceutical platform to public investors at a time when multiple healthcare and technology issuers are lining up to access the equity markets early in the year.

Aktis plans to offer 11.775 million shares of common stock at an expected price range of $16.00 to $18.00 per share, implying gross proceeds of approximately $200 million at the midpoint of the range. Following the offering, Aktis expects to have 46.65 million shares outstanding and at the $17.00 midpoint, this equates to an implied post-IPO market capitalization of approximately $793 million.

The offering is being led by J.P. Morgan, BofA Securities, Leerink Partners, and TD Cowen. Aktis expects to generate approximately $181.7 million in net proceeds which it plans to deploy toward advancing its clinical pipeline and supporting general corporate operations as a newly public company.

*** Aktis updated the financial terms of its IPO on January 7, 2026, increasing the share count in the offering from 11.775 million to 17.65 million while maintaining the price range at $16.00 to $18.00 per share. At the $17.00 midpoint, this raises expected gross proceeds from approximately $200 million to about $300 million and increases post-IPO shares outstanding from roughly 46.65 million to 52.52 million. As a result, the implied post-IPO market capitalization rises from approximately $793 million to about $893 million. ***

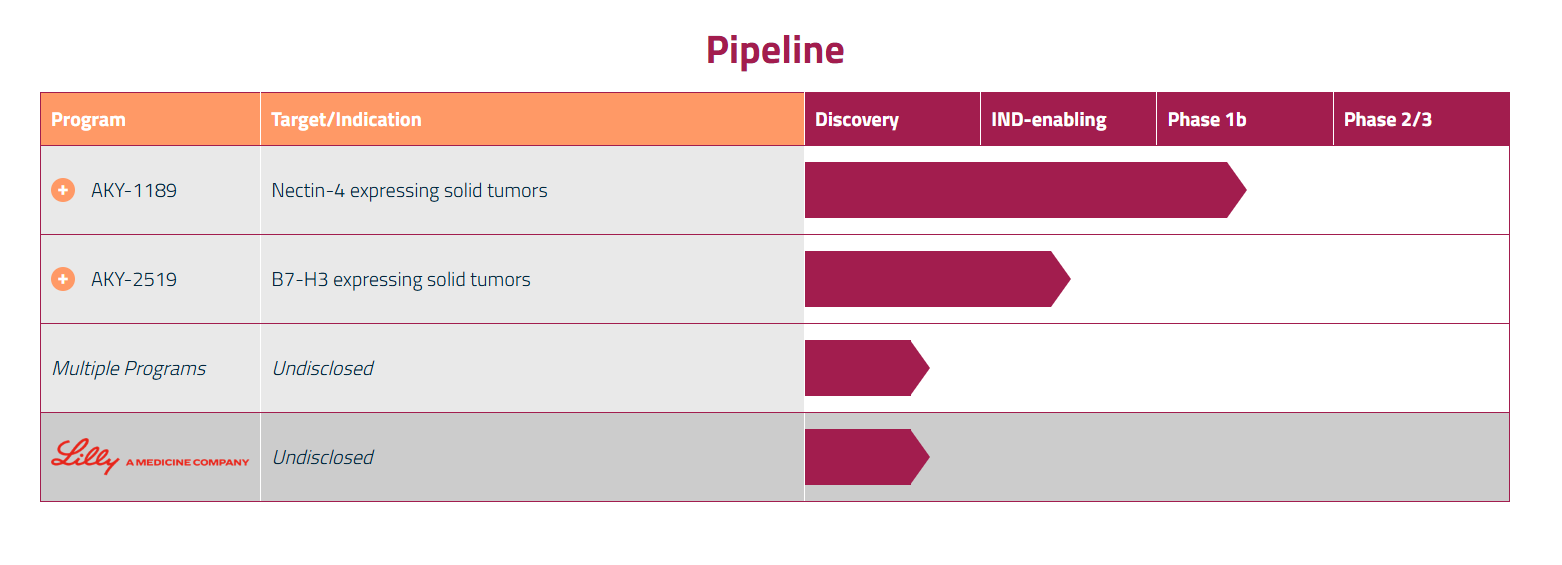

Aktis is a clinical-stage oncology company developing targeted alpha-emitting radiopharmaceuticals using its proprietary miniprotein radioconjugate platform. The company’s technology is designed to deliver radioactive payloads with high tumor penetration while rapidly clearing from healthy tissue, a profile management believes may improve both efficacy and safety relative to traditional antibody-based approaches. Aktis’ lead product candidate, [225Ac]Ac-AKY-1189, targets Nectin-4, a clinically validated oncology target, and is currently being evaluated in a Phase 1b clinical trial for locally advanced or metastatic urothelial cancer, with additional solid tumor indications under consideration.

A second program targeting B7-H3, another broadly expressed tumor antigen, has advanced into human clinical imaging studies, expanding the company’s pipeline breadth. In parallel, Aktis has invested heavily in manufacturing and isotope supply capabilities, an area that has historically constrained the scalability of radiopharmaceutical development. Management believes these internal and external supply chain investments will be a key differentiator as programs move deeper into clinical development.

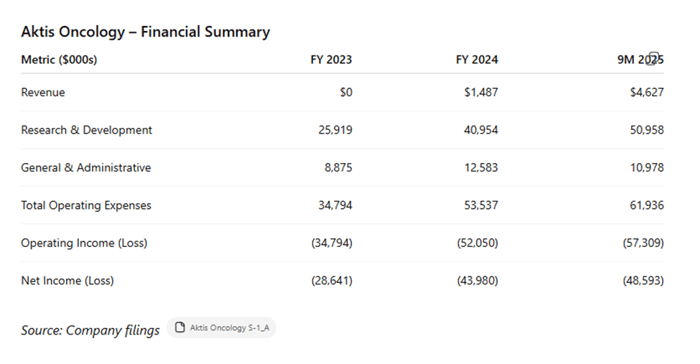

Financially, Aktis remains firmly in development mode, with no approved products and continued operating losses driven by rising research and development spending. The company has generated limited revenue through collaboration arrangements, including its discovery partnership with Eli Lilly, but its cost structure is primarily oriented toward advancing clinical trials and platform expansion.

As the first IPO of 2026, Aktis Oncology is opening the year against the backdrop of what appears to be a busy new issuance calendar, particularly within healthcare and life sciences. While the company’s long-term value creation will ultimately depend on clinical execution, Aktis’ debut highlights a constructive start to the year and reinforces growing momentum among issuers preparing to access the public markets in the months ahead.

Aktis Oncology, Inc. will price Thursday night, January 8th and trade on Friday, January 9th, 2026