Medline Aims for a $5 Billion IPO as America’s Largest Privately Held Medical Supplier Prepares for Its Next Era

Medline Inc., the Northfield, Illinois–based medical products manufacturer and distributor, is advancing toward one of 2025’s largest IPOs. The company plans to raise $5.0 billion by offering 179 million Class A shares at a price range of $26–$30, with an expected listing on the Nasdaq Global Select Market under the ticker MDLN. At the midpoint valuation of $28, Medline would command a fully diluted market capitalization of approximately $37.3 billion, positioning it among the year’s most significant offerings.

Institutional demand is already strong. According to the S-1/A, cornerstone investors — including Capital Group, Counterpoint Global (Morgan Stanley), Durable Capital Partners, GIC, Janus Henderson, Viking Global, and WCM Investment Management — have indicated interest in up to $2.4 billion of the IPO, representing roughly 47% of the deal at the midpoint. The founding Mills Family, which has guided Medline for nearly 60 years, has also indicated interest in purchasing up to $250 million, underscoring both confidence and continuity among its long-standing stewards.

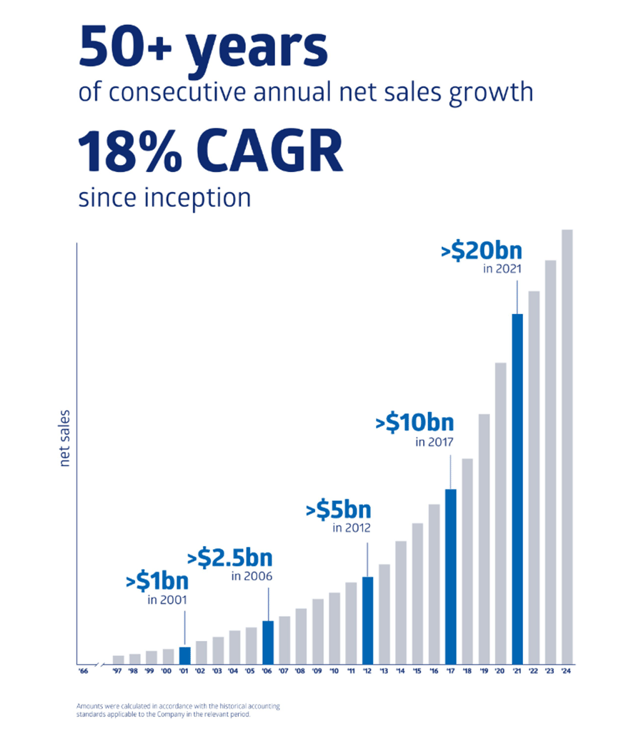

Medline’s modern history begins in 1966, when brothers Jim and Jon Mills founded Medline Industries, building on a family legacy in surgical garment manufacturing. What began as a modest producer of hospital textiles grew steadily through the 1970s and 1980s as Medline expanded into medical-surgical disposables. By the 1990s, the company was rapidly scaling its distribution and manufacturing infrastructure, reinforcing the Mills family philosophy: reinvest in operations, vertically integrate, and cultivate multi-decade customer relationships.

For more than 25 years, Medline was led by the next generation of family leadership — Charlie Mills (CEO), Andy Mills (President), and Jim Abrams (COO). Under their guidance, Medline evolved into the largest privately held manufacturer and distributor of medical supplies in the United States. Leadership has since transitioned to the third generation, with Jim Boyle, grandson of co-founder Jim Mills, now serving as CEO of Medline Inc. The S-1 describes Medline’s culture as a product of “decades of continuous family involvement,” strengthened further by the 2021 investment from Blackstone, Carlyle, and Hellman & Friedman, which helped accelerate facility expansion, automation, and global sourcing diversification.

Operationally, Medline’s scale is unmatched in the med-surg supply chain. The company offers roughly 190,000 Medline-branded products, complemented by 145,000 third-party items sourced from more than 1,250 suppliers. Approximately one-third of Medline-branded products are manufactured in-house across 33 facilities, including highly automated plants in North America. Its 69-facility distribution network, supported by more than 2,000 MedTrans trucks, enables next-day delivery to 95% of U.S. healthcare providers, an advantage critical to health systems seeking predictability, lower labor requirements, and resilient inventory flow.

Medline’s Prime Vendor agreements allow the company to become the primary distributor for major health systems and hospitals nationwide. These long-term arrangements reinforce customer stickiness, streamline procurement for large systems, and give Medline consistent visibility into provider demand. Medline serves nearly all of the largest U.S. hospital systems, underscoring its strategic importance in the healthcare delivery infrastructure.

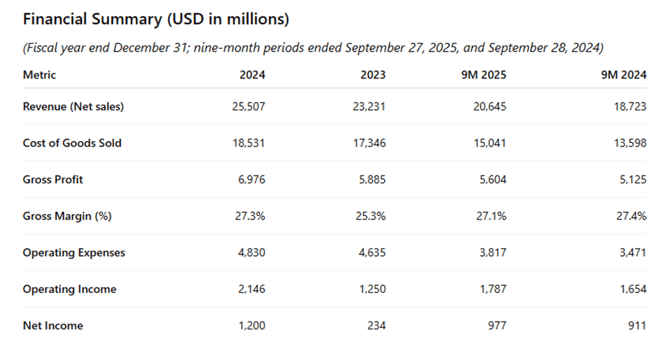

Financially, Medline is entering the public markets with size, momentum, and improving profitability. Net sales grew from $23.2 billion in 2023 to $25.5 billion in 2024, with gross margins expanding as supply chain conditions normalized and manufacturing efficiency improved. Operating income more than doubled between 2022 and 2024, reflecting greater production leverage and cost discipline. Through the nine months ended September 27, 2025, the company generated $20.6 billion in net sales and $977 million in net income, demonstrating the stability and scale of its integrated model even in periods of elevated cost pressure.

From a financial standpoint, Medline presents a rare combination of scale, growth, and improving profitability in a traditionally low-margin segment. Revenue growth has remained steady as Medline deepens its Prime Vendor relationships and expands manufacturing capacity, while operating income trends reflect substantial efficiency gains across production, logistics, and sourcing. The nine-month 2025 results reinforce the durability of Medline’s business model: robust revenue, stable margins, and strong net income even amid inflationary pressures and global supply chain complexity

The IPO marks a pivotal transition for Medline, evolving from a family-operated manufacturer founded in 1966 into one of the largest and most strategically important supply-chain operators in U.S. healthcare. With substantial cornerstone investor support, a clear deleveraging strategy, and longstanding relationships across the nation’s leading health systems, Medline enters the public markets with scale, stability, and meaningful room for continued operational improvement. While the Up-C structure and TRA add some complexity for new shareholders, the company’s integrated model, essential product portfolio, and multi-generational stewardship position it as a durable, long-term compounder in a structurally growing healthcare market.

Medline’s much anticipated debut is expected Wednesday, December 17th, 2025