WALL STREET TAKES A HARD LOOK AT ANDERSEN’S NEXT ACT

Andersen Group Inc., a San Francisco–based tax and advisory firm, has set terms to raise approximately $165 million in its upcoming NYSE IPO by offering 11 million Class A shares priced in a range of $14–$16 per share. At the midpoint, the deal implies a market capitalization of roughly $1.64 billion based on 109.3 million total shares outstanding after the offering. The company will trade under the ticker ANDG, with Morgan Stanley, UBS Investment Bank, Deutsche Bank Securities, Truist, Wells Fargo, Baird, and William Blair leading the underwriting syndicate.

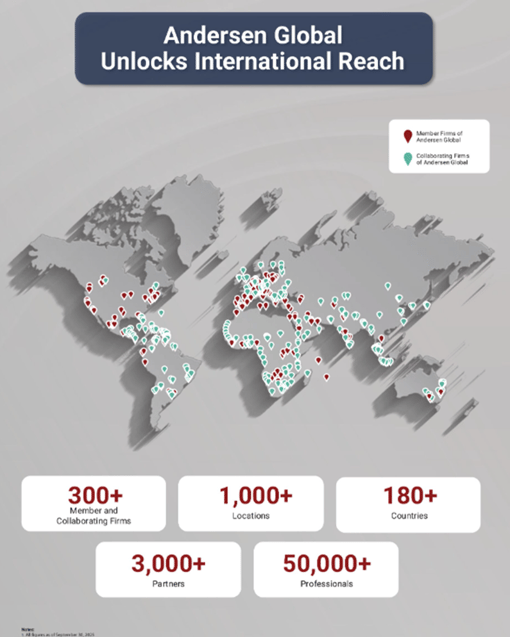

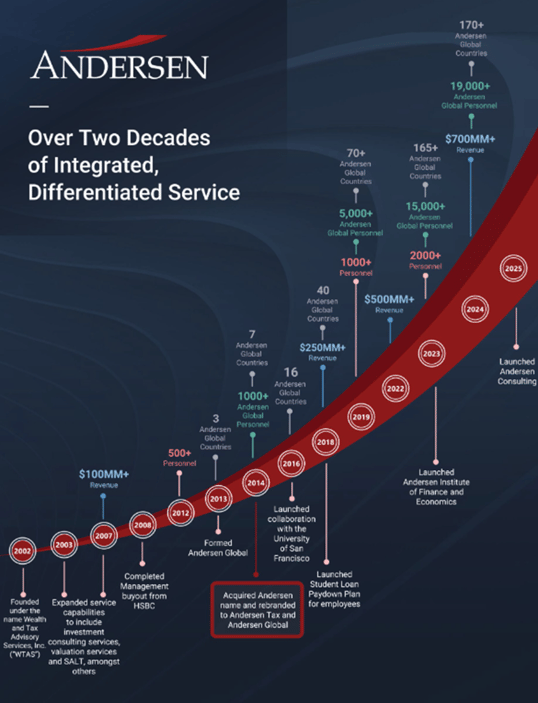

Founded in 2002, Andersen Group is a leading provider of independent tax, valuation, consulting, and private client advisory services to individuals, family offices, corporations, and alternative investment funds. The firm draws heavily on the legacy brand equity of Arthur Andersen, which it purchased and reintroduced to market in 2014, and has scaled significantly through strategic expansion of services, talent acquisition, and affiliation with Andersen Global, a Swiss association of over 300 member and collaborating firms operating in more than 180 countries.

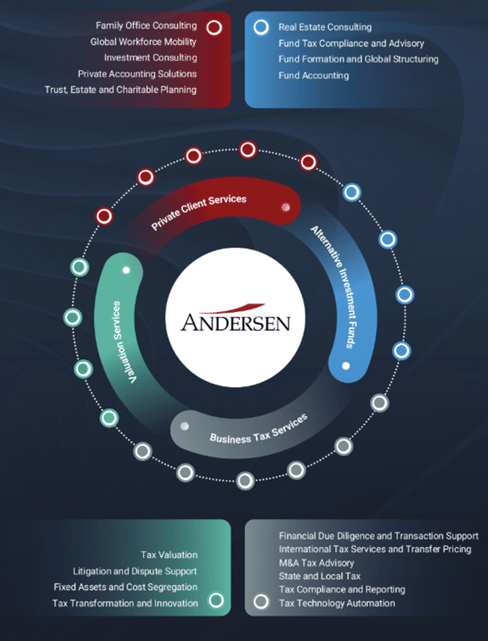

The company positions itself as a non-audit, conflict-free alternative to Big Four consulting practices. By intentionally not providing audit or attestation services, Andersen avoids auditor-independence restrictions and is able to deliver a broader mix of engagements — a strategic positioning that management calls a structural advantage in the S-1/A filing. Tailwinds include increasing tax complexity, expanding international capital flows, regulatory changes, compliance burdens, and a national talent shortage in accounting.

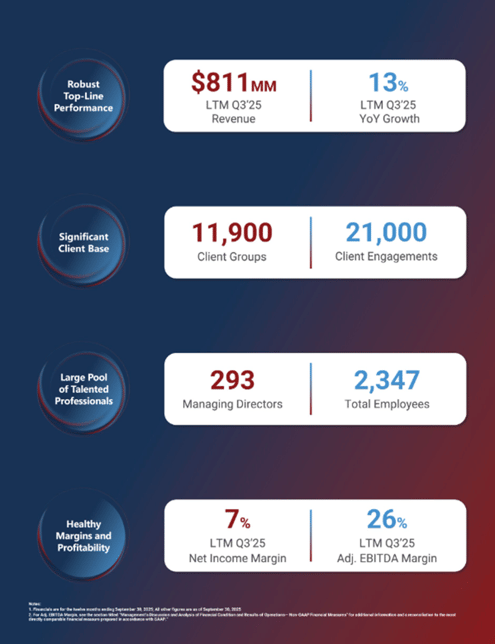

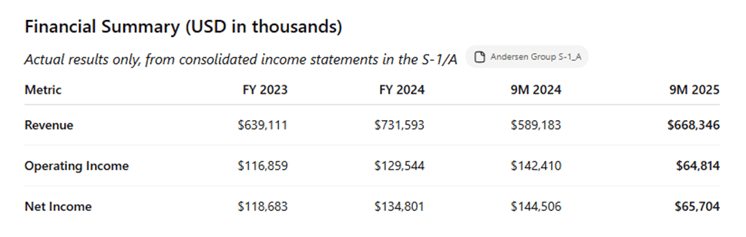

Financial performance has been consistent and profitable over the last two fiscal years, supported by diversified revenue sources across private client services, business tax services, alternative investment funds, and valuation. According to the filing, revenue grew from $639.1 million in 2023 to $731.6 million in 2024, supported by a client base exceeding 11,900 client groups and 21,000 individual engagements as of September 30, 2025. The firm reports high client retention, with approximately 74% of 2024 revenue coming from client relationships extending longer than three years.

Andersen uses a dual-class equity structure in which Class B shares carry 10 votes each, leaving the public Class A float with just 1.1% of total voting power versus 98.9% controlled by Aggregator LLC (a managing director ownership entity) after the offering. Andersen will qualify as a “controlled company” under NYSE corporate governance rules, allowing it to opt out of certain public-company board requirements.

IPO proceeds will be used to purchase newly issued units in its umbrella partnership, invest in technology and AI-driven tax solutions, expand internal training programs, and pursue targeted acquisitions. Management signals an accelerated growth agenda over the next several years, particularly in consulting, valuation, international structuring, and broader financial advisory verticals.

From a financial standpoint, Andersen continues to grow the top line, with revenue up roughly 13% in the first nine months of 2025 compared to the same period in 2024. While profitability compresses significantly in 2025, the filing explains this is primarily the result of non-cash equity compensation and restructuring expenses tied to the firm’s umbrella partnership conversion rather than underlying business deterioration. Operating income and net income remain positive across all reported periods, indicating that Andersen’s advisory model continues to generate recurring, profitable work with a diversified client base even amid transitional accounting adjustments.

Andersen enters the public markets with positive fundamentals, strong retention, long-tenured leadership, a globally recognized brand, and diversified advisory lines. While insider control and material weaknesses in internal controls present governance considerations, the business model benefits from recurring revenue, scalable advisory demand, and a talent-first culture that emphasizes training, professional development, and minimizing turnover.

If management executes on expansion initiatives, particularly in consulting and international tax advisory, Andersen could position itself as a publicly traded platform comparable to Big Four advisory segments, but without audit conflicts — a distinguishing factor the company highlights as a competitive differentiator.

Andersen Group is expect to IPO on Wednesday, December 17th, 2025