The IPO tape is blazing — Klarna, Gemini, Black Rock Coffee, LB Pharma, and WaterBridge all cleared...

IPO Prophet: Deep Dive Into the Oscillator

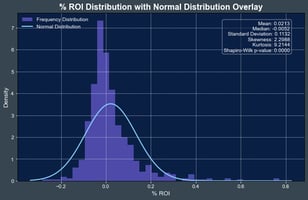

The IPO Market Oscillator has entered a decisive upswing, with its 120-day moving average now rising into the Strong Bull regime for the first time since early 2021. This move reflects a broad and sustained improvement across virtually every dimension of issuance behavior — deal pricing, first-day performance, and technical trading signals.

The composite score’s advance underscores a meaningful shift in investor psychology: risk appetite has returned, deal quality has improved, and secondary-market liquidity has deepened enough to absorb new supply without destabilizing prices. Historically, similar transitions into the Strong Bull zone have preceded periods of elevated deal flow and favorable trading outcomes for new issues.

While the pace of improvement may moderate, the current trajectory suggests the IPO market has regained structural momentum after a multi-year reset.

📈 If you’re new to the IPO Market Oscillator, you can read our introductory post — Introducing the IPO Market Oscillator: A New Barometer of Opportunity — for background on how the composite score is constructed and interpreted.

Breaking Down the Oscillator’s Inputs

To understand what’s driving this rebound, the following plots deconstruct the six underlying components of the IPO Market Oscillator.

Each input captures a distinct layer of the market — beginning with observable deal metrics and moving toward behavioral patterns distilled from our proprietary trading signals.

This ordered progression mirrors the life cycle of an IPO: from offer pricing → first trade → intraday performance → to how our internal signal system responds to those dynamics.

Viewed together through 120-day moving averages, these inputs reveal the structural and behavioral foundation of the current recovery.

Average Premium

The Average Premium measures how aggressively IPOs are priced relative to their indicated range — a proxy for underwriter conviction and investor demand elasticity.

High premiums often accompany exuberant issuance phases; low or negative premiums signal caution and defensive pricing. After a prolonged trough through 2022–2023, the 120-day average has turned decisively higher, indicating that pricing leverage is returning to issuers.

This renewed confidence in valuation is a primary driver of the Oscillator’s upswing and reflects an expanding investor tolerance for risk.

% Above Offer

This measure tracks the proportion of IPOs trading above their offer price — effectively quantifying investor appetite for new issuance relative to valuation.

When this series sustains readings near the upper end of its historical range, it reflects strong follow-through demand and robust aftermarket liquidity.

The current 120-day moving average is approaching prior-cycle highs near 1.0, signaling broad participation and confidence in deal pricing. It remains one of the strongest positive contributors to the Oscillator and a defining feature of the current Strong Bull regime.

% Above Open

The % Above Open series measures how many IPOs close above their first traded price, capturing intraday demand strength and post-open resilience.

Historically, sustained weakness here has preceded broader deterioration in sentiment, while rising values confirm improving liquidity conditions.

Although not yet at prior peaks, the uptrend in the 120-day average shows deepening market participation and better follow-through in early trading — adding steady, mid-level support to the overall score.

% Bullish Flags

The Bullish Flag series transitions us from broad market observation to proprietary signal behavior.

It tracks the frequency with which our stock-specific trading system registers positive signals — defined by intraday patterns such as rising VWAPs, persistent bid strength, and strong early-session demand.

When Bullish Flag triggers cluster across the IPO universe, it indicates that the market is broadly rewarding risk-taking behavior and sustaining trend-following dynamics.

While still below the exuberant highs of 2020–2021, the steady climb in this 120-day average shows constructive engagement and speculative interest returning.

Within the Oscillator framework, Bullish Flags represent a direct, data-driven measure of optimism embedded in our signal architecture.

% Momentum Flags

Momentum Flags capture the frequency of negative momentum triggers — our proprietary risk-control signals that activate when an IPO experiences sharp, sustained post-open declines.

A rising frequency of these events typically accompanies speculative exhaustion or tightening liquidity.

At present, the 120-day average remains mid-range: elevated enough to reflect intermittent volatility, yet far from distress levels.

This balance implies that downside volatility is contained, allowing the positive inputs — particularly Bullish Flags and Premiums — to dominate the Oscillator’s directional bias.

% Absorption Flags

Absorption Flags track instances of post-open supply pressure — events where our risk-control system detects that early selling from initial holders is overwhelming secondary demand.

Historically, high readings signal market fatigue and deteriorating breadth; low readings suggest new supply is being efficiently digested.

The 120-day average remains subdued, indicating that while issuance is picking up, secondary markets are absorbing shares smoothly.

This component exerts only a modest drag on the Oscillator and underscores the structural improvement in liquidity conditions.

From Micro Signals to Market Sentiment

By aggregating thousands of stock-level signal events across the IPO universe, the Oscillator translates our proprietary trade-level intelligence into a macro-level measure of market tone.

It doesn’t just observe price movements — it listens to how our own signal framework is reacting to them.

When positive trading conditions (Bullish Flags) dominate, the market’s collective behavior turns opportunistic; when risk-control signals (Momentum or Absorption Flags) proliferate, defensiveness prevails.

This reflexive design makes the Oscillator uniquely adaptive — a live feedback mechanism that evolves alongside the market it measures.

Putting It All Together

What distinguishes this phase of recovery is its foundation.

Unlike the speculative surge of 2020–2021, today’s upswing is anchored in improving fundamentals rather than exuberance.

Offerings are being priced with discipline, aftermarket performance is broadening, and the negative signal components — Absorption and Momentum — remain contained.

The market is healing in a sustainable way.

If these trends persist, the coming quarters could mark the transition from proof-of-life to true expansion — a period where constructive sentiment, institutional participation, and deal volume finally move in sync.

For now, the Oscillator’s message is clear: the IPO market’s pulse has strengthened, and confidence is spreading.

For Further Context