The Power of Time in Trading

The IPO Prophet's Perspective - The Week of March 31st, 2025

What 2025's Largest IPOs Are Missing

So far this year, we’ve seen three really large IPOs hit the tape—Venture Global at $1.75 billion, SailPoint at $1.38 billion, and now CoreWeave at $1.5 billion. For perspective, in our IPO Prophet database of 810 offerings that meet our framework and go back to 2012, fewer than 10% have exceeded the $1 billion mark. These are typically rare events—at least in terms of deal size—but these offerings have been a lot to digest at this stage of the IPO cycle.

On paper, these are the kinds of deals that should stir the market. But instead of igniting a fresh wave of enthusiasm, they’ve landed with more of a thud than a thunderclap.

We’ve written before about why large offerings like these often struggle to gain immediate traction. Simply put, when a deal is this big, scarcity goes out the window. Unless the company’s growth story is truly off the charts, the market has little reason to assign a premium—especially when there’s plenty of stock to go around on day one.

It also raises questions around the motivations of the sellers and the issuers. Downsizing offerings or signs of weakness in the growth trajectory can be deal killers. They undermine confidence in the quality of the book and suggest there’s too heavy of a push for an extended valuation. Even with solid fundamentals, too much supply can dull the edge.

This dynamic has made the early innings of the 2025 IPO market feel muted. We’re seeing activity, yes—but without conviction. Deals are getting done, but they’re not inspiring the kind of momentum that builds lasting investor interest.

That said, bringing these larger companies public is still a net positive. It signals progress in reopening the IPO pipeline and helps expand the investable universe in public markets. But it also raises a bigger question: are underwriters and issuers prioritizing size over story?

The market doesn’t just need more IPOs—it needs the right kind of IPO. A truly exciting company stepping into the public spotlight with a clean narrative, strong fundamentals, and room for investors to believe. That kind of offering would change the tone in a hurry. And it will come.

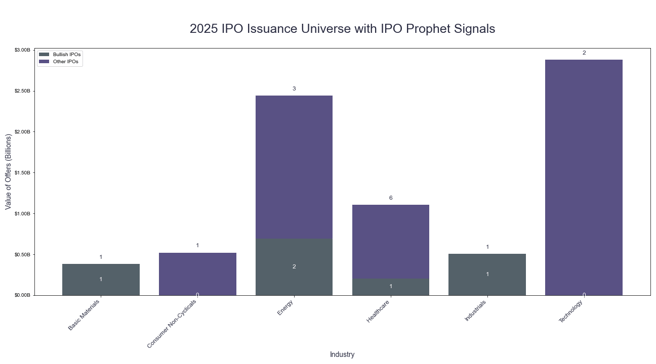

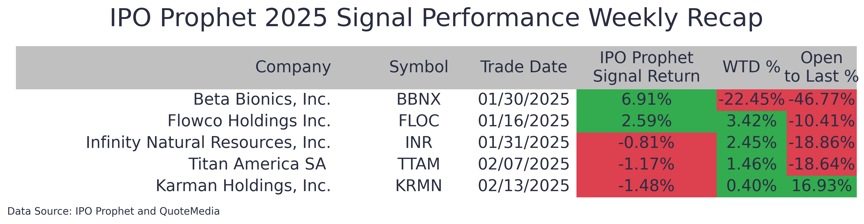

IPO Prophet’s value lies in our proprietary signaling process. We analyze Initial Public Offerings using a suite of algorithms refined over the past 20 years. The table above highlights all IPOs in 2024 where IPO Prophet has generated a Bull Signal, demonstrating returns based on our signals and subsequent performance since the opening trade. While our indicators can be applied to longer-term positions, the data above reflects only the first day’s performance, as our signals are designed specifically for issuance day, with positions marked to market at the close of the IPO’s first trading day. To learn more about our process, here.