These are the moments we have been waiting for. After years of negativity in the IPO market and a...

The IPO Prophet’s Perspective – The Week of June 30th, 2025

The Power of Time in Trading

In trading, the path you take matters just as much—if not more—than the destination. That insight lies at the heart of a powerful concept borrowed from statistical physics: ergodicity.

What Is Ergodicity—and Why It Matters

A system is ergodic if the outcome over time for one participant is the same as the average of many different outcomes taken simultaneously. Most financial systems are not ergodic. That’s because in markets, losses compound more aggressively than gains, and big drawdowns can wipe out long-term potential.

In a non-ergodic world, volatility isn’t just noise—it’s risk. A 50% loss requires a 100% gain to break even. When capital is impaired repeatedly, compounding doesn’t work. For event-driven strategies like IPO trading, this means that managing downside and filtering out noise isn't just prudent—it’s essential.

Assessing 2025: A Year of Caution and Calibration

So far in 2025, IPO Prophet has navigated a market with improving deal flow but uneven investor follow-through. Some trades have posted modest losses. Others, more frustratingly, were missed entirely despite strong upside.

It raises natural questions: Are we fading in an up market? Are the signals too conservative? Have we become too selective?

But these questions must be evaluated in context. IPO Prophet isn’t designed to chase every opportunity—it’s designed to compound over time. That means managing risk while capturing asymmetric upside, and it means sticking to a disciplined process rather than reacting to short-term noise.

Strategy vs. Naive: A Head-to-Head Comparison

To stress-test our framework, we expanded our dataset to include all relevant IPOs—those we traded and those we passed on. This allowed us to compare the IPO Prophet strategy to a true "naive" approach that simply buys every IPO at the open and sells at the close, regardless of signal quality.

Each trade was normalized using a $2 million position size. We tracked:

-

Prophet Return: Entry and exit based on our signal framework

-

Naive Return: Entry at the open, exit at the close for every IPO

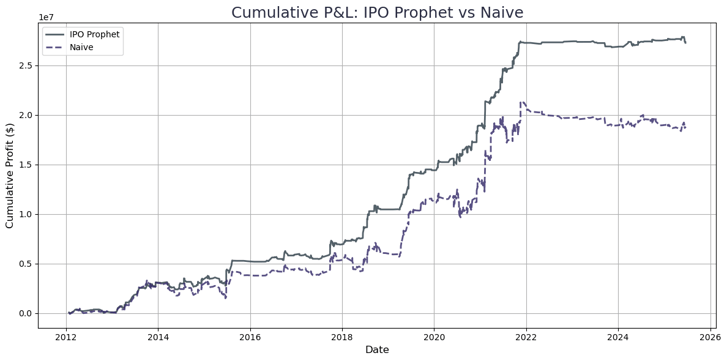

Chart 1: Cumulative Return Over Time

This plot shows the cumulative growth of capital over time. The Prophet strategy compounds more steadily, avoiding large drawdowns. The naive strategy is more volatile and ultimately underperforms.

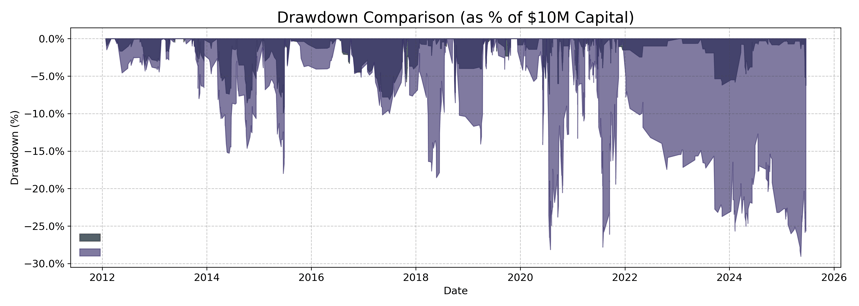

Chart 2: Drawdown Profiles

To ensure drawdowns are contextualized meaningfully, we evaluated them in dollar terms as a percent of $10 million starting capital. A drawdown is calculated as the peak-to-trough decline in cumulative P&L before a new high is achieved.

Drawdown tells the story of survival.

-

IPO Prophet Strategy

-

Max Drawdown: −$990,847 (−7.20%)

-

Average Drawdown: −$240,890 (−1.28%)

-

-

Naive Strategy

-

Max Drawdown: −$2,904,716 (−13.52%)

-

Average Drawdown: −$993,207 (−4.52%)

-

This reinforces our emphasis on downside containment over raw performance.

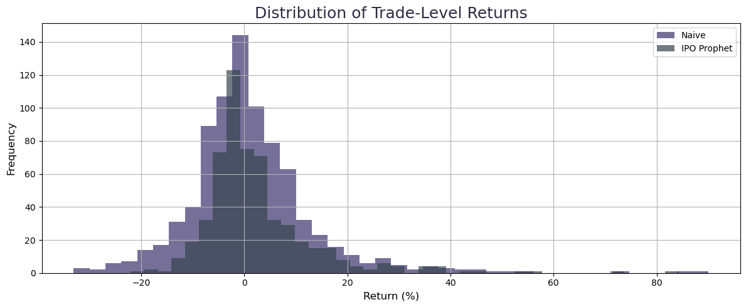

Chart 3: Trade-Level Return Distribution

This chart compares the distribution of individual trade outcomes. Prophet trades tend to cluster around a narrower, more stable band of returns. Naive trades show a wider and more dangerous spread—including a long tail of losses.

This is where filtering matters.

Not every opportunity is worth taking.

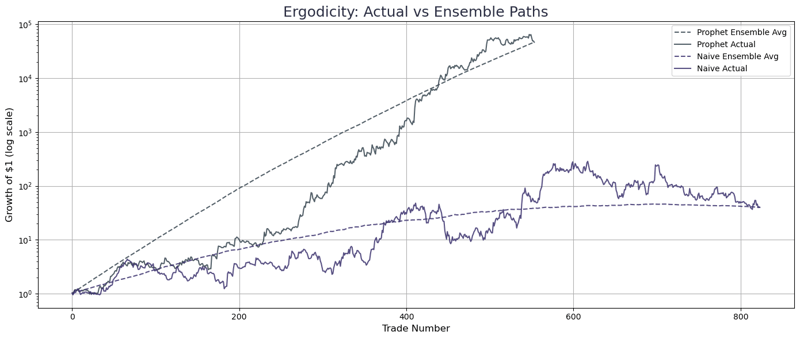

Chart 4: Ensemble vs. Actual Path — A Simulation of Many Worlds

This final chart dives into the core of the ergodicity concept.

We created a Monte Carlo simulation to model what would happen if a trader repeated the same type of trade over and over, but with random sequencing of outcomes drawn from our historical return distribution.

This generates an ensemble path—the average of many hypothetical trading paths taken in parallel universes.

We then compared this ensemble to our actual realized performance over time:

-

IPO Prophet shows strong alignment between the ensemble average and the actual cumulative path—suggesting our process is robust and resilient even under randomness.

-

Naive Strategy, on the other hand, diverges substantially. The average of many random paths looks much better than the real, single sequence. This is classic non-ergodicity at work: theoretical expectation fails to match real-world experience when volatility drags on compounded capital.

In short, the simulation highlights a crucial truth: survivability and path quality matter more than statistical average in non-ergodic systems.

Final Thoughts

IPO Prophet isn’t built to outperform every week or every month. It’s built to survive volatility, avoid ruin, and stay in the game long enough for compound edge to emerge. That’s what non-ergodic discipline looks like.

We don’t need to win every sprint.

We’re built to finish the marathon—and finish it ahead.