Did This Pony Become a Horse...possibly an Uber Horse? Pony.ai was set to price 15 million ADS at a...

The Prophet’s Perspective December 2, 2024

Momentum, Scarcity, and Short Interest in the 2024 IPO Market

The team at IPO Prophet hopes everyone had an enjoyable Thanksgiving holiday and is feeling refreshed as we head into the final stretch of 2024. This time of year tends to be quiet for IPO activity, and last week was no exception. Looking ahead, there’s nothing significant on our radar for this week either. All of the themes we’ve been discussing remain firmly in place.

With that in mind, we thought we’d share a little food for thought to help flush out whatever tryptophan might still be lingering from your holiday meals. Our goal isn’t to demand too much of your time or attention but to present some interesting information that might spark a few ideas.

While our signals focus primarily on the first day of trading, we believe there’s value in exploring longer-term trends in the data. One of our fundamental views is that momentum—both positive and negative—is the primary driver of IPO stock prices. This momentum is amplified by two forces:

- Scarcity of shares, which makes these stocks highly sensitive to price changes.

- Short interest, where bearish bets can pile into stocks perceived as overvalued. While short sellers are sometimes proven right, high short interest can also set the stage for short squeezes, particularly when combined with good news or strong investor demand.

We’ve seen time and again that hot IPOs with high short interest can deliver outsized performance over longer time horizons. To illustrate this, we’ve pulled together data on the 2024 IPO Prophet Cohort, including short interest metrics, market caps, and performance. Below is a table we think highlights some of the dynamics at play—but we’ll let you judge for yourself.

What the Data Tells Us

Here are a few observations we found interesting:

- High Short Interest Often Fuels Volatility: Stocks like Reddit (RDDT) and Loar Holdings (LOAR) showcase the potential for high short interest to drive exceptional open-to-last performance, with gains of 199.34% and 104.62%, respectively.

- Negative Performers and Short Interest Dynamics: Webtoon Entertainment (WBTN) and Ibotta Inc. (IBTA), despite high short interest, have significantly underperformed. This may indicate that the market has rejected their business models or that fundamental challenges have emerged, dampening investor sentiment.

- Room for Exploration: While this data is descriptive, it opens the door to further analysis. Could these metrics help predict which IPOs are most likely to deliver strong performance over time?

Final Thoughts

Momentum and short interest are just two of the many forces shaping IPO performance, but they’re particularly compelling given the scarcity of shares in these stocks. We think this data provides a unique lens into the market and look forward to hearing your thoughts. Do you think short interest metrics are reliable predictors of long-term performance? Drop us a note or reach out through the platform—we’d love to hear from you.

As always, the team at IPO Prophet is excited to tackle the final push of the year and keep delivering insights to help you stay ahead in the IPO market. Stay tuned for more updates in the coming weeks!

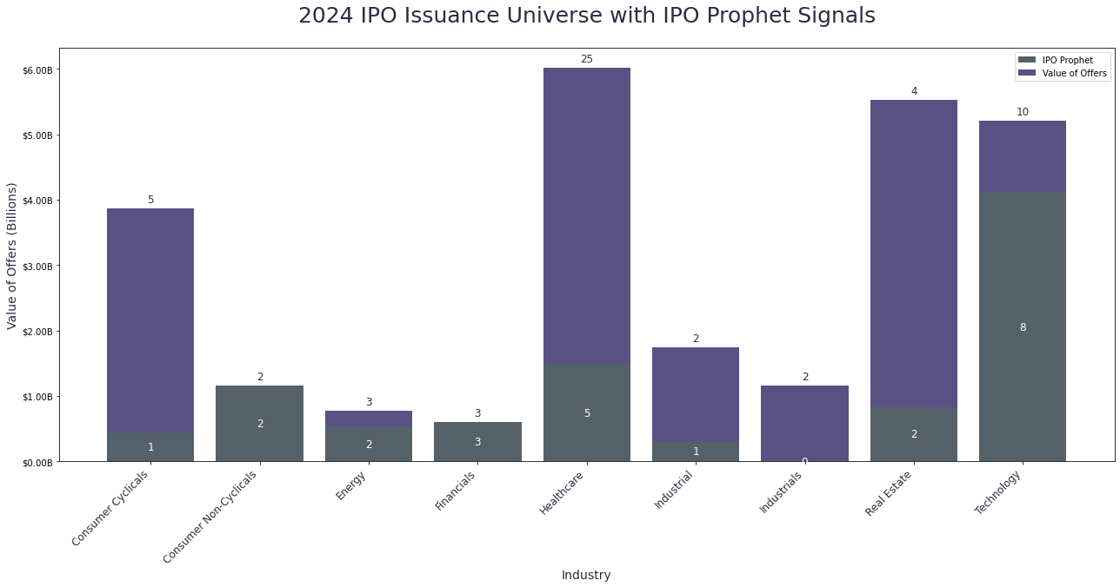

IPO Prophet’s value lies in our proprietary signaling process. We analyze Initial Public Offerings using a suite of algorithms refined over the past 20 years. The table above highlights all IPOs in 2024 where IPO Prophet has generated a Bull Signal, demonstrating returns based on our signals and subsequent performance since the opening trade. While our indicators can be applied to longer-term positions, the data above reflects only the first day’s performance, as our signals are designed specifically for issuance day, with positions marked to market at the close of the IPO’s first trading day. To learn more about our process, here.