They say history rhymes but doesn’t repeat, and in markets, it helps to at least know the tune sung...

The Prophet’s Perspective: Navan’s Debut in Retrospect

|

While we regularly use analogues as a part of our intelligence-gathering process, I wanted to highlight the Navan comparable set as we felt it provided a particularly useful framework for this offering. And in this case, the rhymes of history really reverberated. Earlier this week, we published “Navan’s Tune Has Played Before”, where we noted that Navan’s setup looked similar to a handful of past deals that shared three traits: elevated valuation expectations, heavy issuance size, and a growth story with solid—but not explosive—margins. Those analogues tended to produce muted openings and follow-through weakness, particularly when the opening trade came in below the offer price. The framework wasn’t intended as prediction so much as preparation—a way to recognize the familiar footprints of deals that struggled to find secondary demand after pricing. A Retrospective on the AnalogueIn our prior post, we outlined the cautionary pattern drawn from comparable IPOs. In those cases, initial pricing relative to expectations failed to stimulate follow-on buying, and the first day often devolved into a slow-motion price discovery event below the offer price. The analogue set illustrated a recurring sequence:

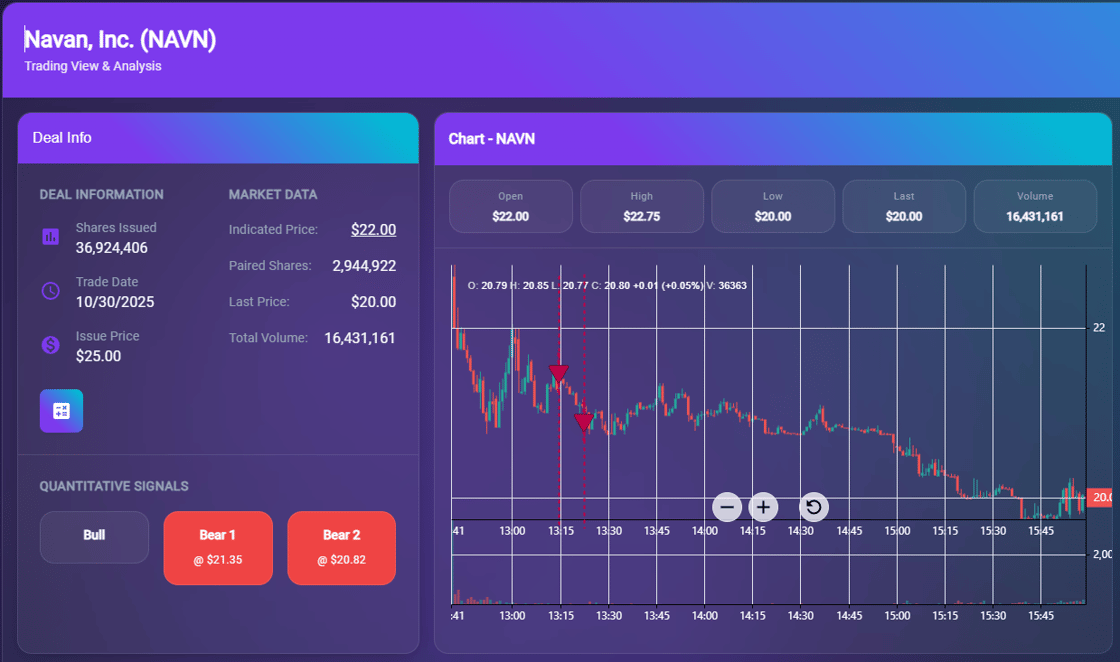

It’s a pattern we’ve observed repeatedly in large-float technology and services names where institutional allocations saturate the opening bid stack. Navan fit that mold almost exactly—and, as it turns out, played to the same script. Day-One Performance: Analogue ConfirmedNavan priced its IPO at $25.00 and opened the session at $22.00, immediately breaking the offer threshold that defines the foundation of our Bull Signal condition. Without an open above offer and early confirmation of upward momentum, the system correctly registered no Bull trigger. An early attempt to regain footing lifted shares to an intraday high of $22.75, but the move sputtered, giving way to incremental weakness. Shortly thereafter, our quantitative engine registered two Bear signals—first at $21.35, then again at $20.82—marking deterioration in both price structure and momentum. Volume throughout the day was tepid—turnover registered at just 44%, placing Navan in the lower third of recent IPOs and consistent with weak open-to-close performers. By the close, Navan traded down to $20.00, completing the full analogue cycle we had outlined earlier in the week: weak open, failed momentum, and a controlled fade. Visual Context: Navan’s First-Day DashboardThe image below shows Navan’s trading session as captured in real time on the IPO Prophet Platform, including deal metrics, intraday price evolution, and the quantitative signal triggers that punctuated the session. The absence of a Bull trigger and sequential Bear activations tell the story succinctly—an IPO unable to find footing after a soft open.

Framing the OutcomeThis was, in many respects, a textbook example of our analogue process working as intended. The historical reference set didn’t predict the future—it prepared us for it. The parallels we flagged offered a lens through which to interpret today’s action in real time, and the quantitative signals confirmed what the analogue implied: an absence of strength, no durable bid, and accelerating weakness into the afternoon session. For followers of IPO Prophet, this outcome underscores the value of marrying empirical signal generation with contextual historical intelligence. The analogue was on point—not because we guessed right, but because markets tend to rhyme when the conditions align. A Note from the TeamAs many of you know, we launched the IPO Prophet Platform at the beginning of the year and have continued to enhance it throughout 2025. Recent additions include our Pre-Offer Scoring System, built on the premise that IPO quality isn’t a mystery—it’s a mosaic. Our ratings framework blends hard data—float, range revisions, order-book dynamics, day-one liquidity, and peer comparables—with informed judgment around sponsor credibility, narrative clarity, and underwriter alignment. The result is a disciplined approach that transforms nuance into rank-ordered conviction—helping you see not just if a deal can work, but how, when, and at what risk. We’ve also added a subscriber notification system delivering real-time email and text alerts for IPO filings, pricings, openings, and intraday signal events—keeping you connected to the market’s pulse even when you’re on the move. At IPO Prophet, we’ve always believed in friends first—business can follow. If you’re reading these posts and want to learn more, reach out and we’ll gladly extend a trial of the platform. |